Process of Stock Trading for Beginners

The stock market can seem complex, but with a clear understanding of the trading process, beginners can approach investing with confidence. Stock trading involves buying and selling shares of companies in the hopes of making a profit. This beginner’s guide will walk you through the basics of stock trading, from opening a brokerage account to placing trades and developing a trading strategy.

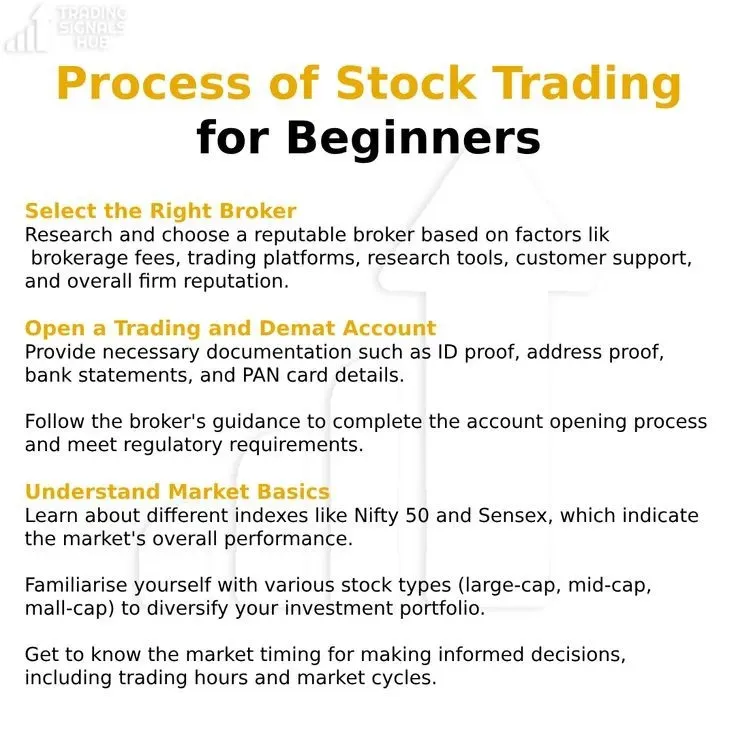

|

| Process of Stock Trading for Beginners |

1. Understanding Stock Trading Basics

What is Stock Trading?

Stock trading is the process of buying and selling shares of publicly traded companies. When you buy a share, you own a small portion of that company. The goal of trading is to buy shares at a low price and sell them at a higher price to make a profit.

Why Do People Trade Stocks?

People trade stocks for a variety of reasons, including building wealth, achieving financial goals, or generating short-term profits. Trading can be a long-term investment strategy or a way to make quick gains, depending on the approach.

2. Setting Up a Brokerage Account

To begin trading stocks, you’ll need a brokerage account—an account that allows you to buy and sell stocks through an online broker.

Choosing a Broker

Selecting the right broker is essential. Look for a broker with the following features:

- Low or No Commissions: Many online brokers now offer commission-free trades.

- User-Friendly Platform: Especially important for beginners, as a straightforward interface can make the process less overwhelming.

- Research Tools: Access to stock research, analysis, and educational resources can be beneficial for learning and making informed decisions.

Opening Your Account

Once you choose a broker, you can open an account online. You’ll need to provide personal information (like your Social Security number and bank details), and you may need to answer questions about your financial situation and goals.

Funding Your Account

After opening your account, transfer funds from your bank account to your brokerage account. These funds will be used to purchase stocks.

3. Learning the Types of Trades

There are different types of trades you can place, each serving a specific purpose:

Market Order

A market order is an instruction to buy or sell a stock immediately at the current market price. This type of order guarantees execution but not the price, so the stock may be bought or sold at a slightly higher or lower price than anticipated.

Limit Order

A limit order allows you to set a specific price at which you want to buy or sell a stock. This can help control the amount you’re willing to pay or accept. The trade will only go through if the stock reaches the specified price, but there’s no guarantee it will be executed.

Stop-Loss Order

A stop-loss order is used to limit potential losses. If a stock’s price drops to a predetermined level, the stop-loss order triggers a sale to prevent further loss. This type of order is particularly helpful for risk management.

4. Analyzing Stocks Before Trading

To make informed decisions, it’s essential to research and analyze stocks. Here are two main types of analysis:

Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health, industry position, and overall performance. Key metrics include:

- Earnings Per Share (EPS): Indicates how much profit a company makes per share.

- Price-to-Earnings Ratio (P/E): Compares the company’s stock price to its earnings, helping to determine if a stock is undervalued or overvalued.

- Dividends: Some companies pay dividends, which are cash payments to shareholders. Dividends can add income to your portfolio, especially if the company has a history of consistent payments.

Technical Analysis

Technical analysis examines historical price and volume data to identify patterns and trends. Common tools used in technical analysis include:

- Charts and Patterns: Candlestick charts, trend lines, and other chart patterns can signal potential price movements.

- Moving Averages: Averages that smooth out price data, helping traders see the general direction of a stock’s trend.

- Relative Strength Index (RSI): A momentum indicator that measures the speed and change of price movements, often used to identify overbought or oversold conditions.

5. Placing Your First Trade

Once you’ve researched a stock and feel ready to invest, placing your first trade is straightforward:

- Log in to Your Brokerage Account: Go to the trading section on your broker’s website or app.

- Enter the Stock’s Ticker Symbol: The ticker symbol is the unique identifier for a stock (e.g., AAPL for Apple).

- Choose Your Order Type: Decide if you want to place a market, limit, or stop-loss order.

- Set the Quantity: Enter the number of shares you want to buy.

- Review and Confirm: Double-check all the details, then submit the trade. Once the trade is executed, you’ll officially own shares in that company.

6. Monitoring Your Portfolio

After buying stocks, it’s essential to monitor your portfolio. Stock prices fluctuate daily, and tracking performance helps you make adjustments as needed. You can review performance based on individual stocks or the overall portfolio and make decisions to hold, sell, or buy more shares based on market trends and your financial goals.

7. Developing a Trading Strategy

A trading strategy is a structured plan that guides your decisions on when to buy or sell. There are different approaches to consider:

Long-Term Investing

Long-term investors buy and hold stocks for several years, focusing on growth over time. This approach is suitable for those who prefer a “set it and forget it” method and are comfortable with gradual returns.

Day Trading

Day traders buy and sell stocks within the same day, taking advantage of small price changes. This strategy requires quick decision-making, a deep understanding of technical analysis, and a higher risk tolerance.

Swing Trading

Swing traders hold stocks for a few days or weeks, capitalizing on short- to medium-term price trends. This strategy requires knowledge of market trends and technical analysis but doesn’t involve as much constant attention as day trading.

8. Managing Risk and Protecting Your Investments

Effective risk management is essential for successful trading. Here are some tips:

- Diversify Your Portfolio: Spread your investments across different sectors to reduce risk.

- Set a Budget: Decide how much you’re willing to invest, and avoid putting all your funds into a single stock.

- Use Stop-Loss Orders: Limit potential losses by setting stop-loss orders on high-risk stocks.

- Stay Informed: Keep up with market news, economic indicators, and events that could impact stock prices.

9. Continuing Your Education

Stock trading is a continuous learning journey. Here are ways to keep growing your knowledge:

- Read Books on Stock Market Investing: Titles like The Intelligent Investor by Benjamin Graham and One Up On Wall Street by Peter Lynch are highly recommended.

- Follow Market News: Financial news websites and platforms like Bloomberg, CNBC, and Reuters provide daily updates on stocks and market trends.

- Take Online Courses: Many brokers and financial websites offer courses for beginners on trading and investing.

Conclusion: Starting Your Stock Trading Journey

Learning to trade stocks takes time, patience, and dedication. By setting up a brokerage account, researching stocks, placing informed trades, and managing risk, beginners can confidently enter the world of stock trading. Remember, start small, continue learning, and adjust your strategy as you gain experience. With these steps, you’ll be on your way to making informed trading decisions and building a portfolio that aligns with your financial goals.